Key Contents

Alok Industries, a penny stock backed by Mukesh Ambani, has seen significant movement in the stock market recently. The stock witnessed a sharp rally, thanks to heavy buying by both foreign institutional investors (FIIs) and domestic institutional investors (DIIs). The company, which has long been part of Reliance Industries’ portfolio, has become a focal point for traders, particularly in the penny stock market.

This article provides an in-depth look into the rise of Alok Industries, its share price history and what this surge means for investors.

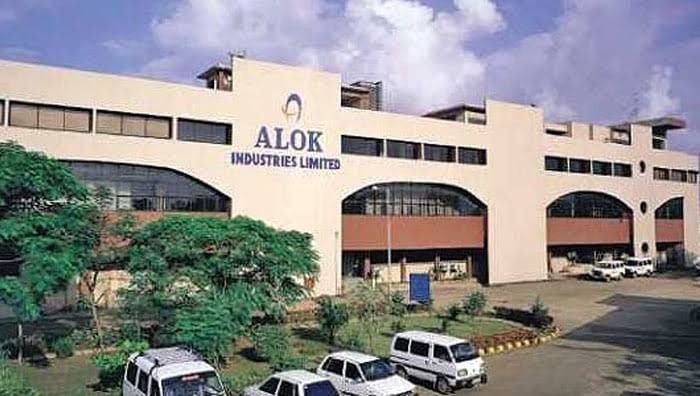

Alok Industries: A Part of Mukesh Ambani’s Investment Portfolio

Alok Industries is a textile manufacturing company that gained attention after being acquired by a consortium led by Mukesh Ambani’s Reliance Industries and JM Financial Asset Reconstruction Company as part of its debt resolution process. Despite being a loss-making company, the stock has managed to attract investor attention, primarily due to its association with Mukesh Ambani.

Share Price History of Alok Industries

Over the years, Alok Industries has fluctuated in value, typical of penny stocks. Penny stocks are often characterized by their low market capitalization and volatile nature. However, due to its acquisition by Reliance Industries, Alok Industries has seen periodic rallies in its share price.

- In 2020, post-acquisition, the stock experienced a surge, reflecting investor confidence in the company’s future under Mukesh Ambani’s leadership.

- In recent times, Alok Industries has witnessed a rally of more than 10%, catching the eye of market analysts and traders.

According to a report by DSIJ, the stock’s surge has been driven by renewed interest from FIIs and DIIs, who have increased their stake in the company.

Why Alok Industries is Attracting Investors

There are several factors contributing to the heavy buying of Alok Industries shares:

- Reliance’s Backing: The company’s backing by Mukesh Ambani through Reliance Industries gives it a level of credibility that attracts investors. Even though Alok Industries has been struggling financially, investors see potential in its turnaround story due to the strategic support of a conglomerate like Reliance.

- Institutional Interest: FIIs and DIIs increasing their stake signals strong confidence in the future prospects of Alok Industries. When big institutional players get involved, retail investors often follow, contributing to the stock’s recent rally.

- Penny Stock Attraction: Penny stocks are known for their potential to deliver high returns in a short span, despite their inherent risk. Traders who specialize in penny stocks often target companies like Alok Industries, hoping to capitalize on any upward momentum.

- Debt Restructuring and Financial Health: Despite its loss-making status, Alok Industries has been steadily improving its financial position following the debt resolution process. Market watchers believe the company’s turnaround efforts could eventually lead to profitability, making it an attractive high-risk, high-reward investment.

Should You Invest in Alok Industries?

The Case for Investing

- Long-Term Potential: Given its backing by Reliance and the gradual improvement in its financial health, Alok Industries could be a good bet for investors with a high-risk appetite.

- Institutional Confidence: The recent increase in stake by FIIs and DIIs could indicate a brighter future for the company. Institutional investors often have access to information and resources that retail investors do not, making their moves worth noting.

- Growth in Textile Sector: The Indian textile sector is expected to grow, especially with the government’s push for domestic manufacturing. Alok Industries, as a key player in this space, could benefit from these macroeconomic trends.

Risks to Consider

- Volatility of Penny Stocks: Penny stocks are notorious for their volatility and Alok Industries is no exception. While the recent surge is promising, investors need to be aware that the stock could experience sharp corrections just as easily.

- Financial Instability: Despite improvements, Alok Industries remains a loss-making company. Its financial health is still a concern and there is no guarantee that the company will return to profitability in the near future.

- Dependence on Reliance Industries: The company’s future is heavily tied to the strategic decisions of Reliance Industries. Any shift in Reliance’s priorities could have a direct impact on Alok Industries.

What Analysts Are Saying

While analysts are cautiously optimistic about the stock, they stress the importance of understanding the risks associated with investing in penny stocks like Alok Industries. According to India.com, the company’s association with Mukesh Ambani has undeniably been a strong driver of interest. However, they urge investors to have a long-term view and be prepared for volatility.

A Penny Stock to Watch in Mukesh Ambani’s Portfolio

Alok Industries is an interesting case of a penny stock that has caught the market’s attention due to its association with Mukesh Ambani and increased institutional interest. While the recent rally in its share price is promising, investors should approach with caution, given the stock’s volatility and the company’s ongoing financial challenges.

For those willing to take the risk, Alok Industries could offer substantial rewards in the long run, especially if its financial health continues to improve. However, it is important to keep an eye on market trends and the company’s strategic decisions moving forward.

Note: This is not a share recommendation, please do your own research before Investing.

For Latest News Updates, Click Here.