Key Content

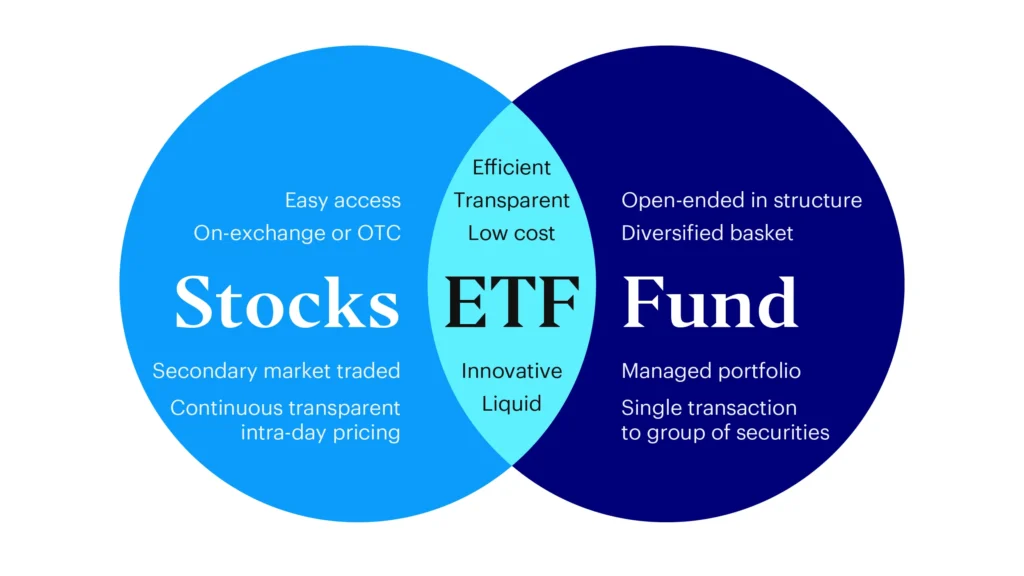

Exchange-traded funds (ETFs) have gained significant traction among investors looking for a versatile, cost-effective way to diversify their portfolios. Originally introduced as an alternative to traditional mutual funds, ETFs offer numerous advantages, making them a popular choice for both beginner and seasoned investors. With over 3,000 ETFs available in the U.S. alone, this investment vehicle caters to a wide variety of asset classes and strategies. So, what exactly makes ETFs so appealing?

1. Low Costs: Maximize Your Returns

One of the biggest draws of ETFs is their cost-efficiency. Traditional mutual funds often come with higher fees due to active management and administrative costs. ETFs, on the other hand, typically have lower expense ratios, which means investors get to keep more of their returns. Additionally, ETFs do not charge 12b-1 fees (marketing fees), further reducing expenses.

The streamlined structure of ETFs also eliminates certain costs like short-term redemption fees that are common in mutual funds. This cost advantage is particularly significant for long-term investors looking to optimize their returns.

2. Flexible Trading: Intraday Moves

Unlike mutual funds, which are only priced once at the end of the trading day, ETFs can be bought and sold throughout market hours, much like individual stocks. This intraday pricing gives investors more control, allowing them to react to market events in real time. Whether you want to take advantage of market volatility or simply prefer the ability to trade at your convenience, ETFs provide the flexibility you need.

Investors can also use different order types, such as stop-limit orders, to further manage risk and lock in profits. Additionally, short selling and margin trading are available with ETFs, giving investors a broader range of strategies to deploy.

3. Diversification and Risk Management

ETFs offer an easy and efficient way to diversify a portfolio. Whether you’re looking to invest in specific sectors, countries, or even commodities, there’s likely an ETF designed to meet your needs. By owning an ETF, investors can gain exposure to a broad basket of securities, reducing the risk that comes with holding individual stocks.

For example, sector-based ETFs allow investors to gain exposure to industries like technology or healthcare, while thematic ETFs can target specific trends such as clean energy or disruptive technologies. This diversification helps investors manage risk while still capitalizing on growth opportunities in niche areas.

4. Tax Efficiency: Minimizing Liabilities

Another significant advantage of ETFs is their tax efficiency. Due to their structure, ETFs typically incur fewer capital gains taxes compared to mutual funds. In mutual funds, capital gains are distributed to investors, often resulting in a tax liability even if the investor has not sold shares. ETFs avoid this by allowing investors to defer capital gains taxes until they sell their shares, providing greater control over tax events.

This tax efficiency can make a substantial difference over the long term, particularly for investors holding ETFs in taxable accounts.

5. Transparency and Innovation

ETFs offer transparency by regularly disclosing their holdings, usually on a daily basis. This transparency helps investors make informed decisions and closely monitor their investments. Furthermore, ETFs are evolving, with innovations such as thematic ETFs and smart beta strategies, allowing investors to target specific investment styles, sectors, or even global megatrends.

A Versatile Investment Tool

ETFs provide investors with a powerful tool to enhance their portfolios through low costs, trading flexibility, diversification and tax efficiency. Whether you are building a long-term portfolio or looking to make strategic trades, ETFs can help meet your investment goals.

For Latest News Updates, Click Here.