Table of Contents

The Government of India, led by Prime Minister Narendra Modi, has announced a new pension scheme called the Unified Pension Scheme, which aims at overhauling the system of retirement benefits for central government employees. Much interest has been accorded to the new scheme, more so in comparison with the already rolled-out National Pension System (NPS). While the government continues to define and sharpen its approach to retirement planning, awareness of the major differences between both the UPS and the NPS can help any current or future retiree in the system.

Unified Pension Scheme: An Overview

The Unified Pension Scheme is the newly approved retirement plan by the central government to provide a more unified and comprehensive structure for pensioning in its employment. It is expected to integrate the generally practiced pension processes so that all employees of the central government can have a standardized, probably better retirement plan.

UPS is envisioned to replace or supplement the existing NPS, which was introduced in 2004 and currently is the dominant retirement savings vehicle of government employees. However, UPS is not a replacement but rather an improvement upon the predecessor. It has various benefits that improve on some of the criticisms and challenges correlated with NPS.

Distinguish between UPS and NPS

Whereas both the UPS and NPS have the same orientation toward securing the financial future of government employees, several differences between them could be clearly extracted.

1. Fund Management: This is one of the key differences between UPS and NPS. It is expected that UPS will offer more governmental control on fund management and hence more stability and predictable returns. Under the NPS, the funds are managed by the private fund managers but by working under the regulatory framework provided by PFRDA.

2. Risk and Returns: Since its inception, there was always some amount of risk associated with an NPS. UPS seeks to counter-balance this risk by providing more stable returns wherein the retirement money of their employees is safe from market fluctuations.

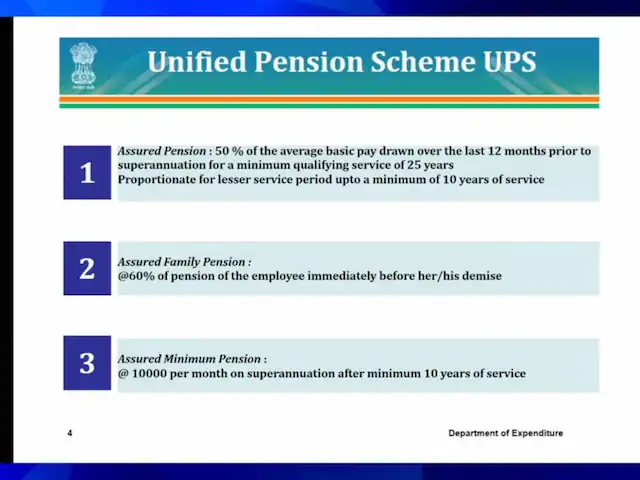

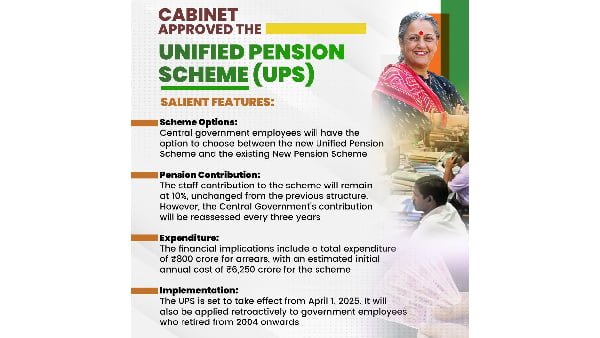

3. Contribution Structure: Under UPS, the contribution structure may differ from that of the NPS, primarily with regard to the structuring of the government’s contribution. Although actual details of how UPS’ contribution model is going to function have not been fully disclosed, it is envisaged that the government will continue to play a major role in funding the pension accounts and perhaps contribute more or more consistently than under NPS.

4. Retirement Benefits: At best, the factor that can make UPS most attractive to any potential job aspirant will be the improvements to retirement benefits, which would include a better computation of the pension quantum, survivor benefits, and also perhaps a minimum guaranteed pension, which was one of the grievances against the NPS.

5. Voluntary Contributions: While the NPS allows for voluntary contributions to be made by employees to increase retirement benefit, it is not yet known what sort of treatment such contributions would get under UPS. Indeed, there could be more incentives on UPS for voluntary contributions, in which case it could be a fantastic way to encourage staff to save more.

The Government’s Case for UPS

The Unified Pension Scheme comes at a time when the government wants its workforce to have better and more robust financial security. The NPS, despite several advantages, was always criticized for its exposure to market risks and variability of pension amounts, leading to apprehensions over adequacy of retirement savings.

It is with regard to these that the UPS should provide a more secure and predictable pension plan, especially for those people nearing retirement. Besides this, the initiative by the government to centralize and unify pension management under the UPS manifests its interest in improving efficiency and effectiveness in the pension system.

Impact on Central Government Employees

This is, therefore, an opportunity beckoning towards central government employees with the introduction of the UPS. It is likely to offer more stability and security in retirement—the significant concerns that many employees expressed against the NPS on account of its reliance on market-linked returns.

Secondly, the UPS could make retirement planning easier and less complicated with regard to pension management. This is especially vital in a country like India, where retirement planning forms the most important single component of financial security for millions of government employees.

Conclusion

The Unified Pension Scheme launched by the Modi government represents an important paradigm shift in how retirement benefits have been structured for central government employees. The UPS will try to make a much more secure and stable retirement plan by overcoming some of the limitations of NPS. The employee will need an understanding of how the scheme stands vis-à-vis NPS and what it means for their financial future, once the details are out.

For Latest News Updates Click Here